Sustainability Leadership & Impact

Our Approach to Sustainability

Since 2013, we have embedded purpose into our corporate vision: Every investment improves our climate future. Integrating this purpose into our business model allows us to quantify both downside exposure and upside opportunities – all in support of delivering meaningful long-term value and impact.

Our thoughtful and rigorous approach to sustainability and impact embraces the concept of double materiality, focusing on both issues most material to our business and those externalities our business most impacts.

Our Impact

6.6 Million

Cumulative metric tons of carbon dioxide (CO2) avoided annually through our investments, the equivalent to eliminating emissions from over 1.4 million typical passenger vehicles

6.3 Billion

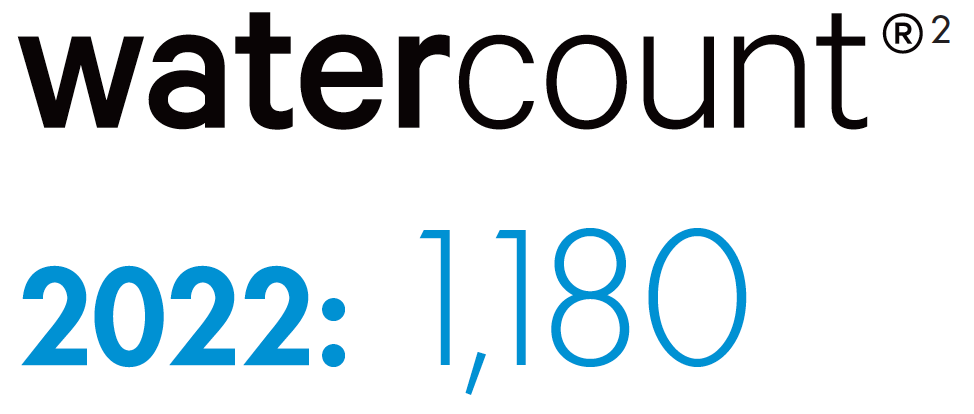

Cumulative gallons of water saved annually from our investments, the equivalent to eliminating the annual water consumption of nearly 138,000 U.S. homes every year

~400,000

Quality jobs created by our investments in 48 states

~300,000

School children supported by our energy efficiency upgrades to educational facilities and transportation funded by our investments

~2 Million

Veterans served by hospitals and other facilities that received energy efficiency upgrades funded by our investments

Sustainable Development Goals

The United Nations Sustainable Development Goals (SDGs) represent the biggest and most complex challenges of our time. At HASI, we prioritize the 10 SDGs that are most relevant to our expertise, business objectives and corporate citizenship goals.

Our Sustainability Journey

- First U.S. public company focused on climate positive investing

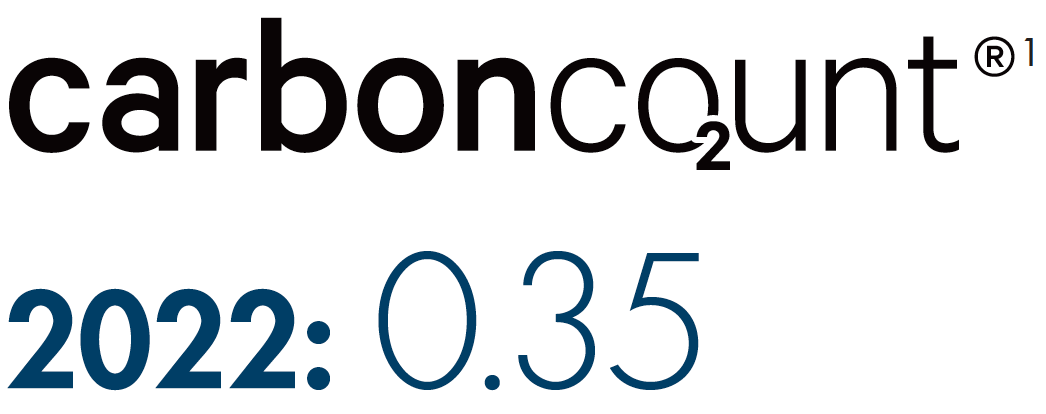

- Launched CarbonCount scoring tool

- First HASI SYB issued for energy efficiency assets

- Published first Sustainability Report Card

- Issued first rated HASI Sustainable Yield Bond (SYB) for real estate assets

- Recognized by Climate Bonds Initiative as Green Bonds Pioneer

- One of first U.S. public companies to commit to Task Force on Climate-Related Financial Disclosures (TCFD)

- First U.S. public company to sign the “We Are Still In” declaration in support of climate action to meet the Paris Aggreement

- Formalized Board oversight of sustainability strategies, activities, policies, and communications

- Implement TCFD recommendations and integrated into SEC filings

- Achieved 100% renewable energy procurement target

- Became a signatory to the UN Global Compact (UNGC)

- Appointed Teresa M. Brenner Lead Independent Director

- Inaugural $500m corporate unsecured green bond issuance

- Joined the UNGC’s Business Ambition for 1.5ºC: Our OnlyFuture Campaign

![]()

- Invested $1.9b in climate solutions

- Recorded highest annual CarbonCount in company history

- 2m MT of incremental annual reductions in carbon emissions

- Issued >$900m in green bonds

- Joined Partnership for Carbon Accounting Financials (PCAF)

- Enhanced DEU with board appointments, internal management, and expanded SEC filing disclosures

- Declared Social Dividend of $1m to capitalize newly launched Hannon Armstrong Foundation

![]()

- Invested $1.7b in climate solutions

- 800k MT of incremental annual reductions in carbon emissions through our closed transactions

- Raised >$1.5b in CarbonCount-based debt

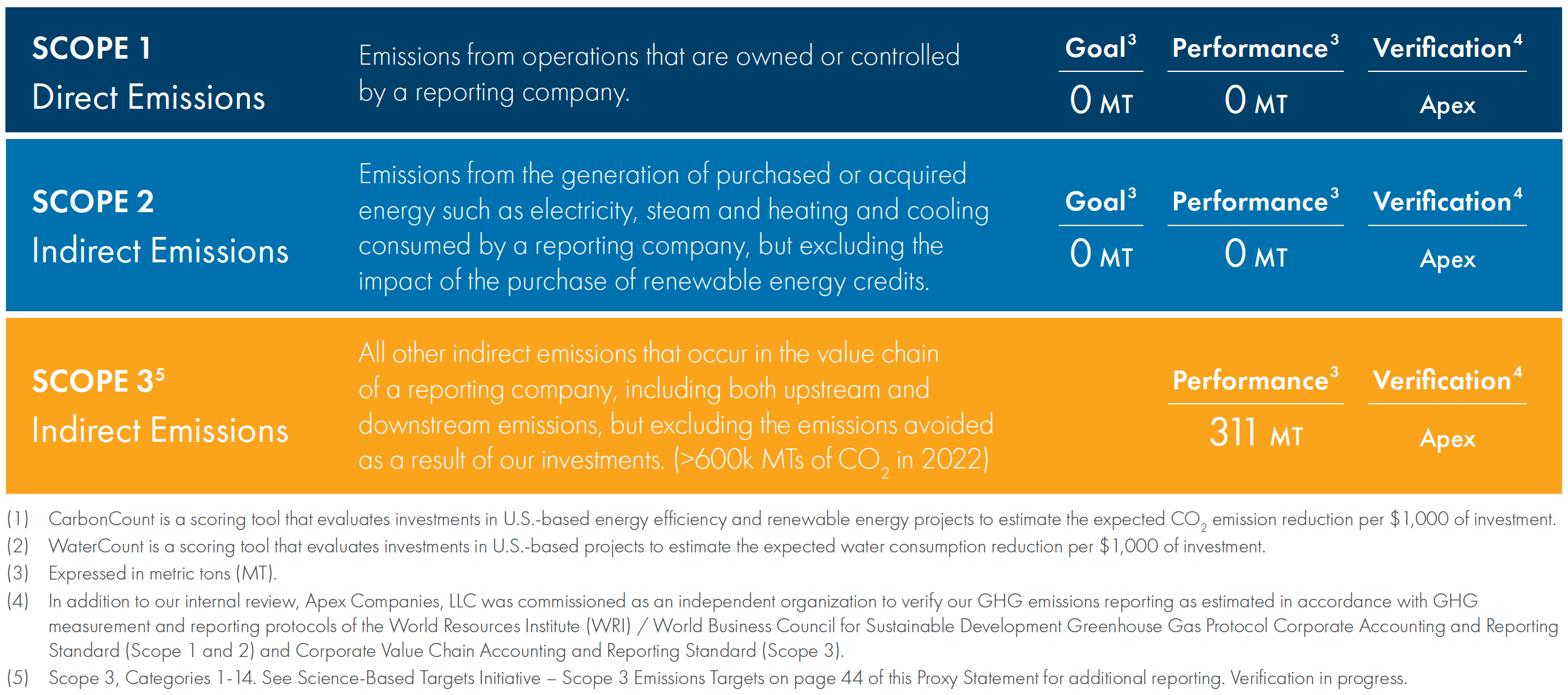

- Submitted Scope 1 and 2 emissions targets to SBTi

- Enhanced DEIJA through expanded public disclosures and reported a majority of new hires as women or people of color

- Joined Net Zero Asset Managers initiative

- Amended bylaws to enhance shareholder rights

- Declared Social Dividend of $1.6m to support Hannon Armstrong Foundation

![]()

- Invested $1.8b in climate solutions

- >600k MT of incremental annual reductions in carbon emissions

- Launched CarbonCount 2.0

- Implemented internal price on carbon

- Scope 1 and 2 Targets Validated by SBTi

- Declared $1.85m social dividend to support HASI Foundation

- Established multiple Business Resource Groups

- Published Materiality Assessment

- Recognized as A List by CDP

2022 Highlights

$1.8b

invested in climate

solutions

Implemented Internal Price on Carbon

Published Materiality Assessment

Recognized

as A List by CDP

>600k MT1 of incremental

annual reductions in

carbon emissions

Launched CarbonCount 2.0

Published Policy Engagement Report

>$1.85m

social dividend declared to support HASI Foundation

Co-Founded Emissions First Partnership

Established multiple Business Resource Groups

1) Metric Tons

People

Diversity, Equity, Inclusion, Justice, and Anti-Racism (DEIJA)

Mission Statement

HASI’s recognition of the importance of diversity, equity, inclusion, justice and anti-racism are essential to the success of our business. Our company is more than just the sum of individual roles, skills, and productivities. We are also a team that values the mutually reinforcing empowerment of people of all races, culture, identities, gender expressions, sexual orientations and learning and engagement styles. By opening ourselves to the broadest range of talent, we improve both our company performance and our ability to attract and retain talent. We know it is inherently the right way to conduct business.

Strategic Implementation

Our comprehensive, values-driven approach to diversity, inclusion, equity, justice and anti-racism comprises initiatives that aim beyond legal compliance, to foster an innovative, creative culture where every member of our team can bring their best and most authentic selves to work. We incorporate our efforts throughout all levels of our organization by:

- Informing our management training efforts through the work of the DEIJA Working Group to ensure they include, but are not limited to, a focus on multicultural leadership, understanding bias and anti-racism

- Supporting consistent conversations within our team and facilitated by outside experts to better learn from and understand our different respective experiences and perspectives

- Actively expanding the sourcing of our candidate pool to increase the breadth of its diversity

- Challenging our business partners to share our DEIJA values and practices

- Tracking, analyzing and furthering employee pay equity

- Ensuring our philanthropic efforts consider all views on how to address the intersection of climate and equity

- Regularly reviewing existing company policies and practices to make updates where and as needed to align our actions with our values

- Consistently engaging on a corporate level in the protection of voting rights to support a vibrant democracy

Board Oversight

In accordance with its charter, the Nominating, Governance and Corporate Responsibility Committee (NGCR) of our Board of Directors supervises all matters related to DEIJA, including identifying and vetting Director candidates (in anticipation of vacancies), helping formulate the company’s DEIJA strategy and monitoring DEIJA performance metrics. The NGCR Committee meets at least quarterly to provide oversight, field updates and inform the DEIJA strategy’s overall direction. In addition, the Committee’s Chair periodically participates in meetings with investors particularly concerned with DEIJA-related topics.

- 82% Independent

- 36% Female

- 18% Racial or Ethnic Minority

Climate Justice

In early 2022, we adopted an organizational Climate Justice Statement to affirm our commitment to advancing social justice in tandem with our mission of investing in climate solutions.

Principles of Governance

The Board of Directors works directly with our CEO, who guides the company’s operations, which are executed by our officers and employees. Our Board comprises 11 members, 82% of whom are independent, elected annually by our shareholders.

At HASI, we acknowledge the significance of considering, assessing, and tracking sustainability and impact-related opportunities and risks as part of our broader vision and strategy. The Nominating, Governance and Corporate Responsibility Committee (NGCR) plays a vital role in regularly reviewing our strategies, activities, and policies, including our Sustainability Investment Policy, Environmental Policies, Code of Business Conduct and Ethics, Human Rights Statement, and Human Capital Management Policies. This sustainability and impact governance structure ensures that we remain aligned with our sustainability and impact goals and objectives.

![]()

HASI Board of Directors

Nominating, Governance, and Corporate Responsibility Committee

Chairman and CEO

Sustainability & Impact Leadership Team

HASI Foundation

Leadership Team – Sustainability & Impact Reporting

Frameworks

Committee – DEIJA Working Group

Prosperity

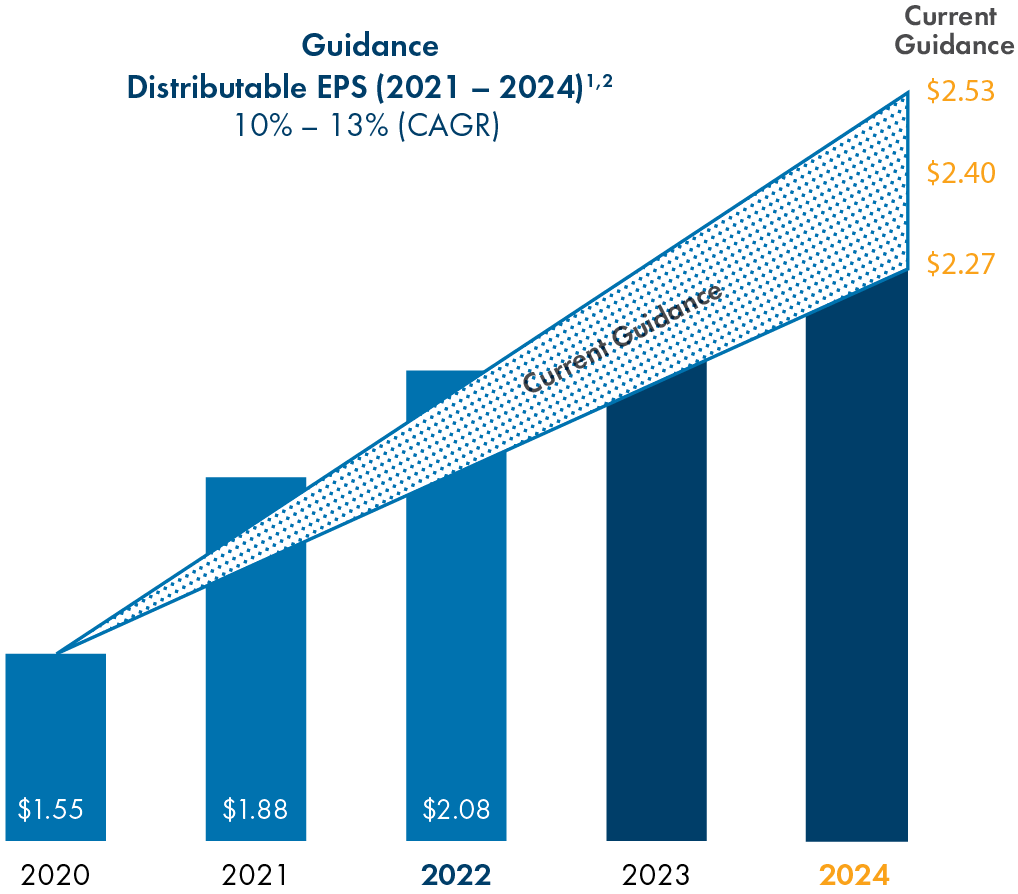

Increase and Extension of Guidance

Distributable EPS

Expected Compounded Annual Growth

Distributed EPS (2021 – 2024)2: 10% – 13%

DPS: 5% – 8%

1) See Item 7 to our Form 10-K, filed on February 21, 2023 with the SEC, for an explanation of Distributable Earnings, Distributable Net Investment Income, Portfolio Yield and Managed Assets, including reconciliations to the relevant GAAP measures, where applicable.

2) Relative to the 2020 baseline.

Giving Back

The HASI Foundation was created to add a long-term strategic lens to our maturing corporate philanthropy efforts targeted at the intersection of climate action and social justice. This effort flowed from an organic expression of shared values that fits naturally within our culture of fierce curiosity and rigor about outcomes in climate investing.

The foundation is funded by annual Social Dividends declared by HASI and the proceeds from an internal price on carbon assessed against HASI’s Scope 1, 2 and 3 emissions (net of the avoided emissions resulting from investments). Over the last three years, HASI has contributed nearly $4.5 million to the foundation.

Vision

We seek to accelerate a just transition toward an equitable, inclusive and climate positive future.

Focus Areas

Climate Solutions for Disadvantaged Communities

Support for organizations providing direct access to affordable energy efficiency, renewable energy and health-enhancing products and services to low-to-moderate income households and disadvantaged communities

Climate Solutions

Career Pathways

Support for programs targeted at historically underrepresented communities and communities impacted by climate change and/or the energy transition that provide education on climate change impacts and training for careers in climate solutions

Local

Impact

Support for organizations across the District of Columbia, Maryland and Virginia region that strengthen the social fabric and promote economic and climate resilience

2022 Grantees

In 2022, the HASI Foundation granted a total of more than $900,000 to the below organizations:

| Organization | Program | Focus Area(s) |

|---|---|---|

| Southface | GoodUse | Disadvantaged Communities, Local Impact |

| Strategic Energy Innovations (SEI) | Climate Corps Fellowships | Career Pathways, Local Impact |

| Groundsville | Community Resilience Hub Program | Disadvantaged Communities, Local Impact |

| Morgan State University | Climate Solutions Scholarship Program | Career Pathways, Local Impact |

| Miami University | Climate Solutions Scholarship Program | Career Pathways, Local Impact |

| Rumie | Climate Change Action Leadership Library | Disadvantaged Communities |

| Native Renewables | Hozho Homes Program | Disadvantaged Communities |

| Chesapeake Bay Foundation | Clagett Farm | Disadvantaged Communities, Local Impact |

| Fair Chance | General Support | Disadvantaged Communities, Local Impact |

| Severn River Association | General Support | Local Impact |

| YMCA of Anne Arundel County | General Support | Disadvantaged Communities, Local Impact |

Policies & Disclosures

HASI’s sustainability policies, principles, and reporting disclosures aspire to the highest ethical standards. For additional information, navigate to the linked documents.

Policies & Disclosures

HASI’s sustainability policies, principles, and reporting disclosures aspire to the highest ethical standards. For additional information, navigate to the linked documents.

Download PDF

Download PDF